In 2014, Lisa Suennen was named as one of the Top 50 People in Digital Health by Rock Health, Goldman Sachs, Fenwick & West and Silicon Valley Bank and also as one of 15 Disruptive Women to Watch in 2015 by Disruptive Women in Healthcare. Here, this venture capital investor, author and Managing Partner of Venture Valkyrie Consulting, LLC, provides an overview of her recent report, her perspectives on the evolution of healthcare accelerators, and important checklists to follow.

I am excited to announce that the California Health Care Foundation (CHCF) has just published a report, authored by me, about the state of healthcare Accelerators in the U.S. and around the world. For those of you who don’t know CHCF, it is a very large not-for-profit endowment that has a mission to improve the quality, cost and efficiency of healthcare delivered to the underserved populations of California. In so doing, they also provide a very valuable educational service to the overall healthcare community and fund the creation of reports like this one about Accelerators.

The new report, entitled Survival of the Fittest: Healthcare Accelerators Evolve towards Specialization is available for download HERE. This report is intended to update the report that CHCF released two years ago entitled “Greenhouse Effect: How Accelerators are Seeding Digital Health Innovation” about the then emerging field of healthcare Accelerators. I would have to say that two years later in 2014, these programs have definitely emerged.

In fact, there are now more than 115 healthcare dedicated Accelerators in the US and four other continents, nearly one for every Starbucks. Well, not quite, but the proliferation is profound. Here are some statistics for you (again, this is only healthcare accelerators; if we included all of the other kinds, I don’t think there would not be enough room on the Internet to describe them all):

- 87% of the accelerators are in the US (76%) in 25 of the 50 states

- 36% of the accelerators were in CA and 27% in NY, mirroring the distribution of the venture community to a large degree

- 93% of the accelerators (82% of the total) are focused on digital health and health IT, while the balance span other healthcare sectors

- 40 of the accelerators receive venture capital backing (35%)

- 61 of the accelerators receive backing from large corporations (54%)

I am quite sure we didn’t find them all so these statistics are undoubtedly understated. If you click HERE you will be able to go on the CHCF website and look at the list of Accelerators that were included in the report (to add up to the 115, I mean). CHCF intends to keep a running list so you can check back frequently to see who is out there, new, old and in-between. If you want to add your Accelerator to the database because we missed it, you can do that now and HERE. I am hoping we hear from the penguin health Accelerator in Antarctica, as that is the one flavor we haven’t come across yet.

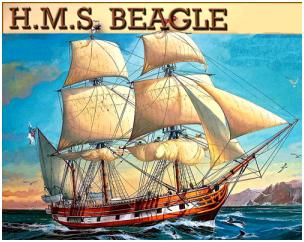

As the Accelerator world begins to mature, one can also now see the early signs of evolution similar to those that Darwin observed when looking at various forms of sea life way back in his day. Darwin noted that as species evolve, they must specialize and change or risk death, and we are seeing this very same thing play out on the Accelerator front. Given what I have seen in my recent travels, here is what I know for sure: if Darwin were alive today, there would probably be an Accelerator forming on The Beagle.

Coming soon: a new accelerator

I hate to give away all the punch lines of the report, so you will just have to read it for yourself. However, a few extra tidbits that didn’t make it in are here below (as you can imagine, I can’t be quite as Lisa-ish in a commissioned report as in my blog). Among my many discussions with a myriad of willing report interviewees (thanks to all of you!), I started collecting some funny stories that I have begun to refer to as Tales from the Accelerator Crypt. A few of them are here below for your amusement.

- From an East Coast Economic Development-Focused Accelerator: By far the worst idea pitched to us was from a company that proposed to prevent falls among the elderly with a vest containing an airbag whose deployment is triggered by EEG signals coming from a wearable computer brain interface. It’s probably obvious why this is so insane. Getting beyond who might actually wear such a thing around their home or to bed, can you imagine the number of erroneous deployments from the notoriously unpredictable, noisy EEG signal? If only they had made a video. That same week in the same city, I was amazed to be introduced to a rival company also developing a wearable airbag for accidental falls, but at least this one was triggered by an accelerometer. File under “You know wearables have jumped the shark when…”

- From a University Program in CA: The most awful pitch we had was from a clinician-entrepreneur whose answer to every probing question on commercial viability was “This is going to save countless lives.” It was his answer to every question, clinical to operational to financial. The most entertaining stage moment, however, was when a CEO of a company developing a ‘next generation’ needle-free injector did a live demonstration of his product by injecting himself with saline while up on stage doing his pitch. He unbuttoned his shirt, gave himself the shot and buttoned up again, claiming how painless it was. As he continued to speak, blood pooled and spread from the injection site, down his arm and across his entire white shirt. It was a slow motion disaster. He didn’t recover very well. Needless to say they didn’t win the demo day competition.

- From an East Coast Independent Accelerator: Learning how to stand up and represent your company is a critical part of being a good CEO, but it doesn’t come easily to everyone. While some are able to do it, pitching in front of an audience can be terrifying and emotional for others. We have seen this play out in several ways. We had one founder who hated to pitch so much that he literally stood on stage silent for an entire minute before exiting stage left. Another was so scared that he had his brand new CTO stand in for him at the last minute. Since the guy had been there one week he didn’t really have any details about the company or know how to answer questions. We had one session where the CEOs tried to stand out from the crowd and be creative by using clothing as a differentiator. Unfortunately it backfired because all chose the same thing—bow ties–so they all ended up looking alike anyway.

- From a Not-Exactly an Accelerator in Europe: Accelerators create a lot of value by teaching entrepreneurs to pitch well under pressure. As the Irish say, “How do I know what I think until I hear myself speak?” To emphasize the point, we asked companies to introduce themselves and their companies while hitting a series of softballs. We thought this was a good way to test founders’ ability to get their message across quickly while multi-tasking. As they progressed to six-minute presentations we changed the format.The entrepreneurs always ran over the allotted time, so we started hitting baseballs at those who didn’t finish on time. With 30 seconds left to the end of their presentation one of us would stand up with a bat and walk towards the pitching machine. We got to see who worked well under pressure and who stopped and shutdown. We had more than a few hit-by-pitch situations. It ended in rather dramatic form on the final demo day with one of our guys swinging for the fences from the stage and ending up smashing four beers glasses and a jug. We decided to stop the baseball after that.

Go Giants!

To use that baseball concept as a transition in this, the month of the Major League Baseball Playoffs (Go Giants!), one of the things that occurred to me during the writing process is that entrepreneurs and potential accelerator sponsors could use a score sheet of some sort to keep track of what they are looking for when shopping for an Accelerator program. Thus, I created two checklists for this purpose. They don’t allow you to keep a box score, but they might help you think through the decision of where you belong on the Accelerator spectrum. You will find those checklists below at the end of this post.

Again, I want to thank everyone who subjected themselves to my questions for this report. I also want to thank CHCF for making the report possible, as I know it is a topic of great interest to many. Again, the report can be downloaded HERE. If you wish to see the original “Greenhouse” Report from 2012, you can find that in the CHCF archives HERE.

And if you’re running that penguin health Accelerator, don’t forget to write!

_______________________________________________________

Accelerator Checklists

An Entrepreneur’s Checklist of What to Consider When Choosing an Accelerator Program

Why am I doing this again?

☐ I don’t have a clue how to start a company

☐ To get my hands on some seed capital

☐ I need some equally crazy friends while I do this

☐ To get to those customers who won’t return my calls

Accelerator type I’m most attracted to:

☐ Independent

☐ Affiliated with a particular company or organization

☐ Product-focused

☐ Focused on regional job creation mainly

☐ At my alma mater so I can still feel like a student

☐ Focus on customer partnerships; I don’t need an education

Location:

☐ Wherever I get accepted is fine,

☐ Wherever I like the people best

☐ Wherever I happen to live; I can’t relocate for 4 months!

☐ Where the sun shines in winter

Management and Mentors:

☐ Are mostly former entrepreneurs

☐ Are mostly big company healthcare industry people

☐ Are mostly technology types

☐ Are mostly absent; I’m in it for the cash

Involvement of sponsors:

☐ Specific target customers are sponsors

☐ Sponsors not relevant to my company, but could be helpful

☐ Warm bodies with money are fine with me

☐ I love doing endless pilot programs

Duration:

☐ 12-16 weeks ought to do it

☐ Prefer ongoing programming, maybe a year or more

☐ Until they kick me out; I like the cheap rent

Fellow entrepreneurial participants:

☐ Are mostly new to healthcare but good with technology

☐ Are healthcare veterans but new to technology

☐ Are pretty well clueless on starting a company, like me

☐ Are good to drink with and provide a great community

Financing & Equity:

☐ Take equity but give lots of cash

☐ Take no equity but very small limited cash contribution

☐ Have a follow-on fund for when I need more money

A Sponsor’s Checklist of What to Consider When Considering Funding an Accelerator Program

Why am I doing this again?

☐ To enhance my innovation initiative

☐ To find some companies to buy/financial returns

☐ To fulfill my desire to teach/collaborate

☐ To network with other industry participants

☐ For the public relations value

☐ To get out of the office

Preferred Accelerator type:

☐ Independent; I will be a participant but not set the agenda

☐ Company-owned: why help other companies innovate? This baby is all mine….

☐ Product-focused: really need some fresh R&D blood to enhance adoption

☐ Partner-focused: I’m here to make a deal; who wants to hang out?

☐ Recruitment focused: let’s get some entrepreneurs into this stodgy workplace

Programming type:

☐ 12-16 weeks is good; I can quickly evaluate these ideas

☐ Long-term/year or more is better; I can really see what these people and ideas are made of

☐ As long as the beer lasts, I’m in

Sponsor executive involvement level desired:

☐ Sponsor team members actively engaged as mentors

☐ Sponsors expected to deliver real business opportunities

☐ Sponsors pay up and come to meetings, but not expected to participate actively

☐ I’m just here for the free food and beer

Return on investment priority:

☐ I want some equity in these companies and it better pay off

☐ I want to infuse entrepreneurial spirit in my team

☐ I want to find some M&A deals for my money

☐ I want to be recognized as an innovation leader

☐ It’s really for my own branding and PR; the stock options will make lovely wallpaper some day

This article first appeared on VentureValkyrie.com, and is reprinted with permission. For more expert insights from Lisa Suennen, follow her on Twitter @VentureValkyrie, on her blog, and through her book: Tech Tonics: Can Passionate Entrepreneurs Heal Healthcare with Technology?

The nuviun blog is intended to contribute to discussion and stimulate debate on important issues in global digital health. The views are solely those of the author.